Home

What we offer

User-oriented Digital Asset Management

The power to manage your investments, access cross-chain transactions, and monitor your portfolio with ease. Proprietary segregated wallet technology ensures that your funds are always secure and that you have complete control over your assets.

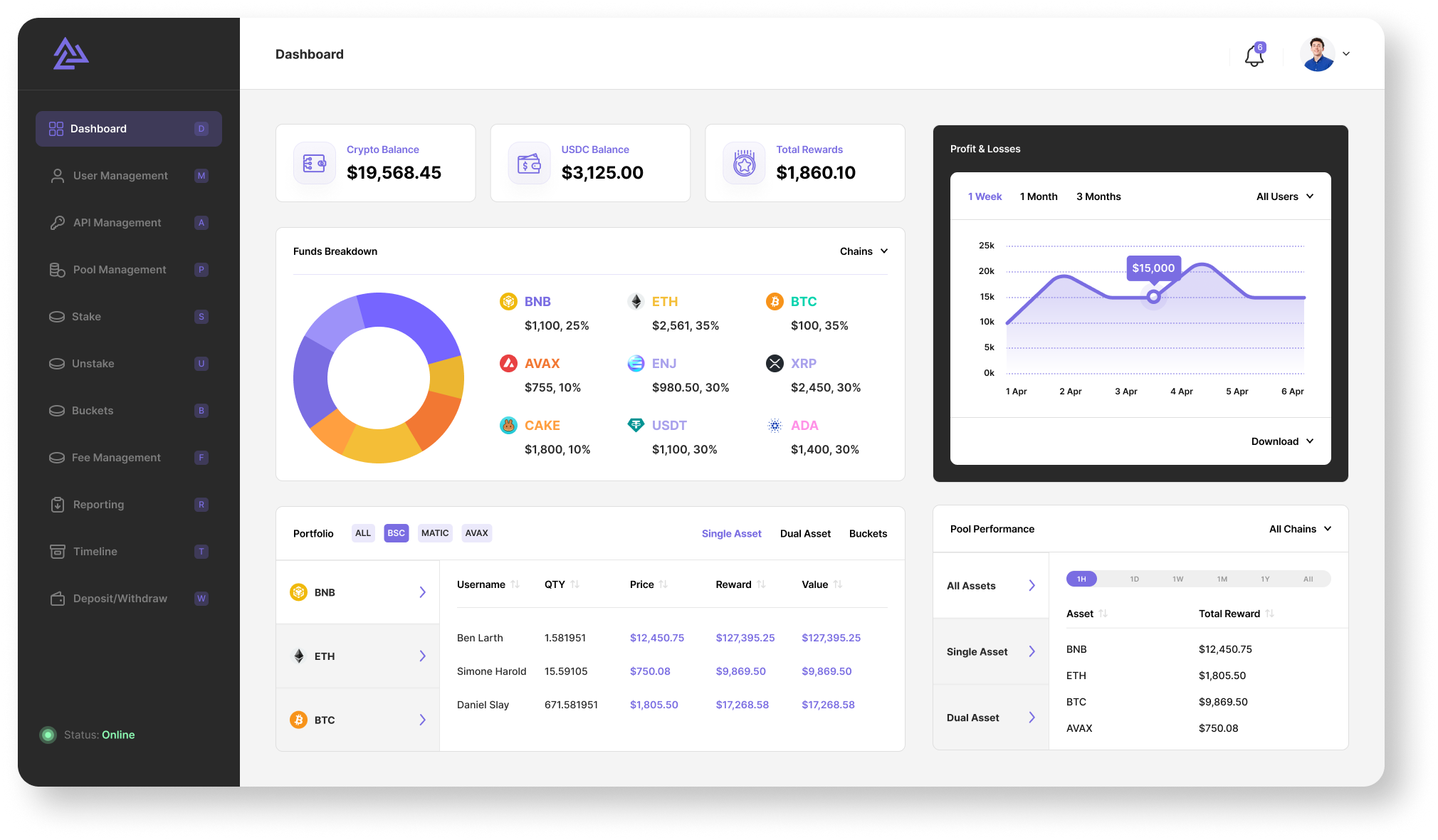

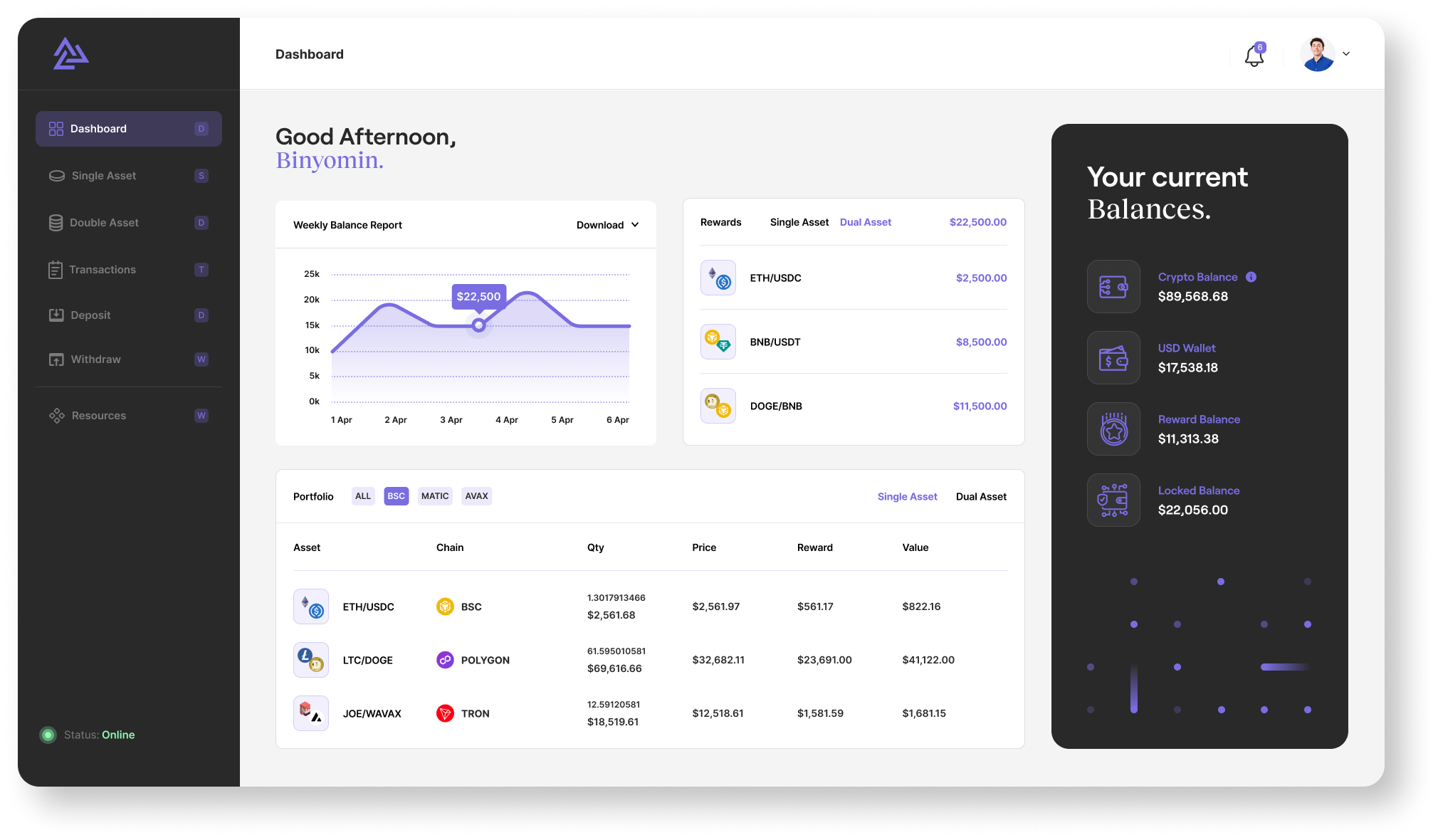

Bird's eye view

Discover important insights on your dashboard

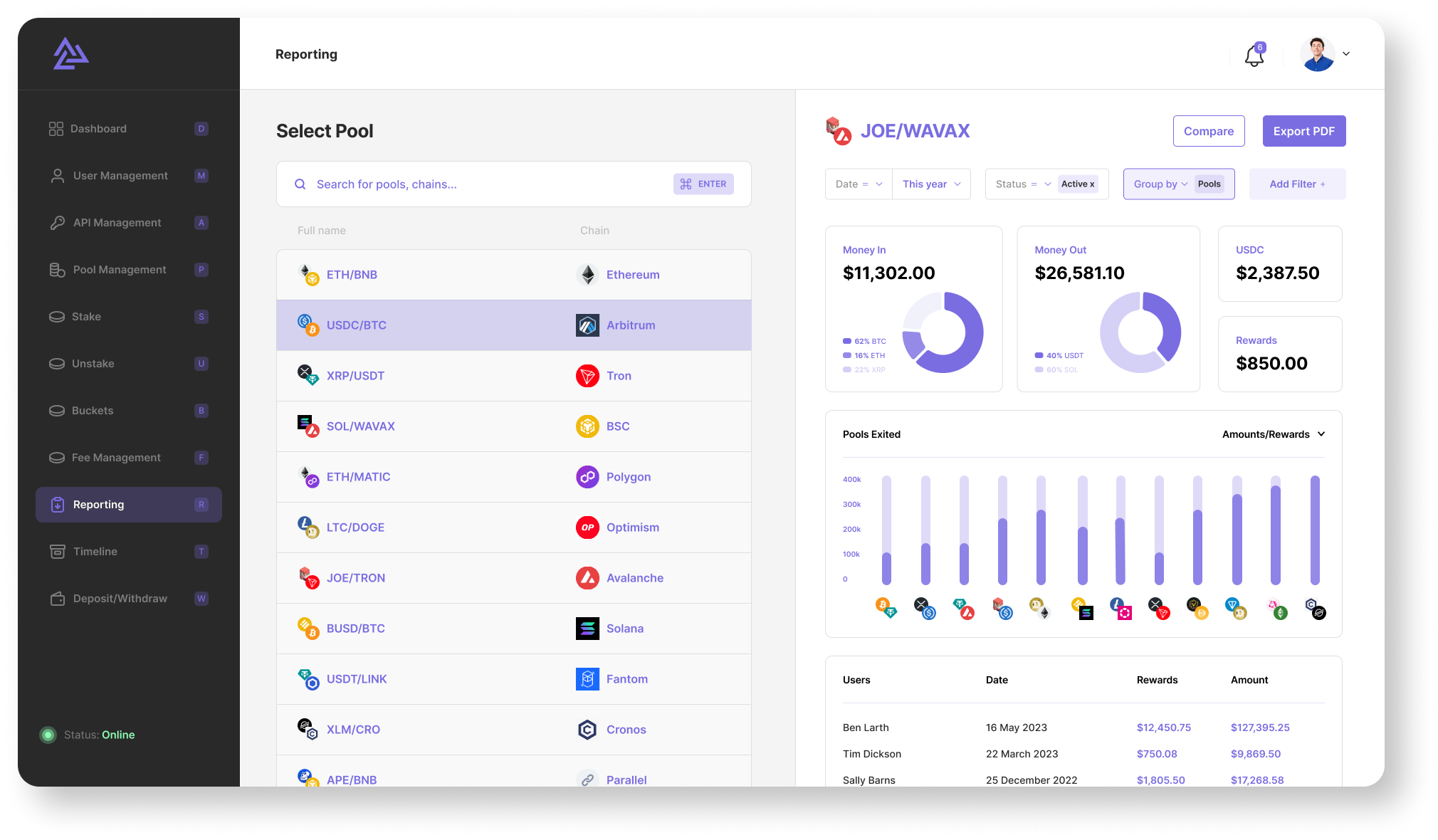

Amotius platform offers brokers portfolio management tools and a reporting portal, allowing them to efficiently handle multiple client accounts. They can manage cross-chain strategies, maintain risk categories, and control investment capital ratios within their clients' portfolios.

user friendly

Smart, Powerful Retail Dashboard

Users can directly manage their funds and investments on the Amotius platform, adhering to region-specific licensing regulations in collaboration with licensed partners.

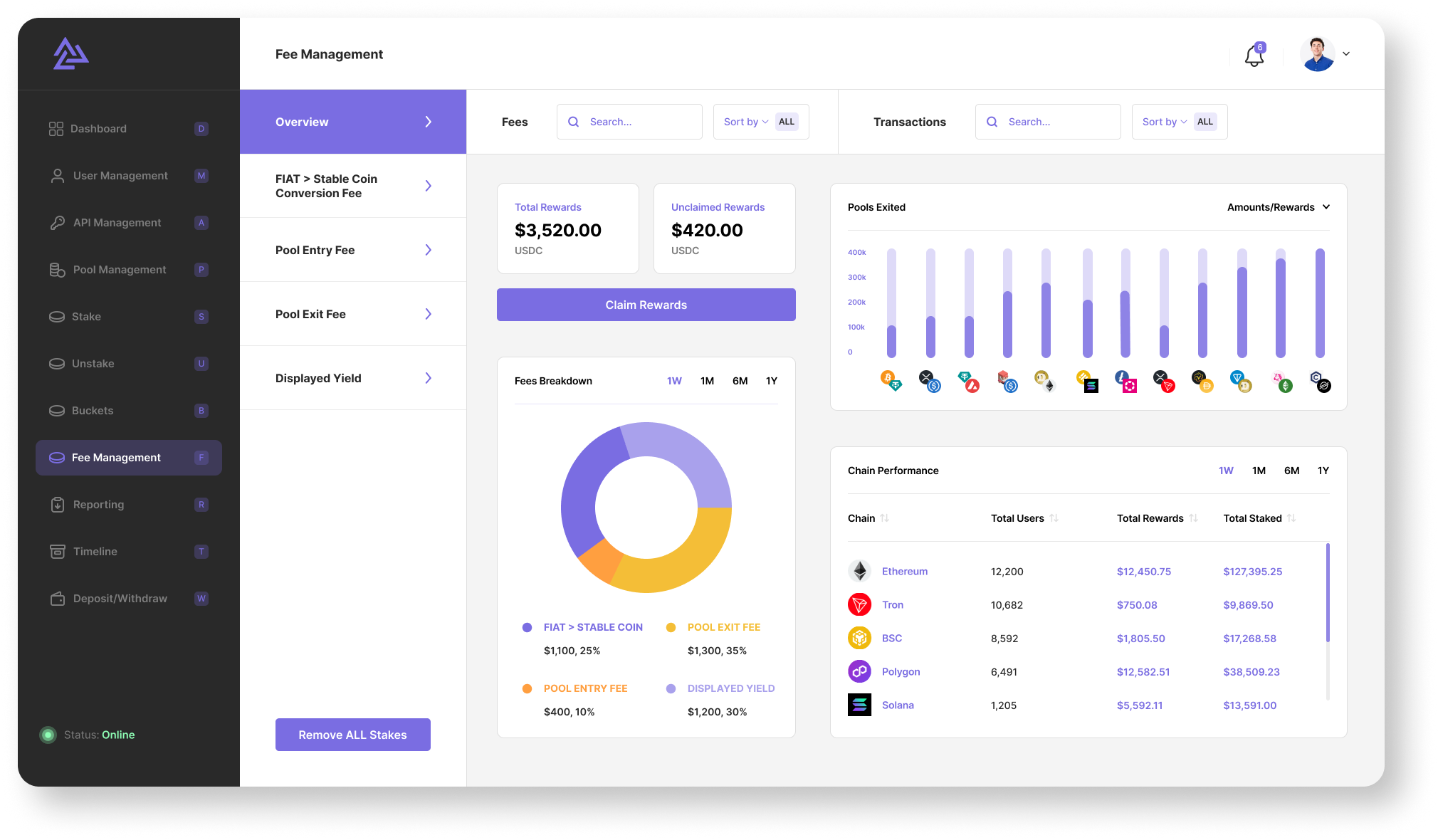

Fees

Bespoke Fee Management

The platform offers customizable fee structures based on region, pool, or user preferences, including FX fees, entry/exit fees on strategies, swap fees, yield fees, and success fees. Brokers can benefit from automated on-chain fee retrieval as well.

How we help

A Smart and Comprehensive DeFi-as-a-Service Solution

Our DeFi-as-a-Service solution provides a client-centric approach to digital asset management, offering comprehensive infrastructure, services, and tools for users to confidently trust their financial managers and intermediaries.

Cross Chain Simplified Access

With just a few clicks, you can access a range of financial products and services that would typically require significant technical knowledge and time to navigate

Portfolio Management

With our platform, users and fund managers can effortlessly deposit fiat currency without the hassle of dealing with multiple blockchains and setting up numerous wallets.

Smart dashboard

Institutional partners can seamlessly integrate Amotius DeFi Connect into their existing tools via API or utilize white-label capability. This integration empowers their customers to access on-chain yields through their wealth management platform, leveraging existing integrations.

On Chain Transparency

Secure segregated wallets enable easy asset conversion and withdrawal, ensuring transparent tracking and seamless user experience.

Decentralised Private Keys

Using trustless MPC implementation, multiple parties engaged in the computation are coordinated using blockchain consensus, while digital asset ownership is tracked across the connected Layer 2 blockchain. MPC offers the possibility of storing crypto assets online without compromising security.

CryptStake

CryptStake serves as the bridge between Web 2.0 and Web 3.0 technology, facilitating the connection of bespoke DeFi and Web3 products to institutional partners' customers through a seamless and user-friendly solution

“

We Are Transforming Digital Asset Management Through Our Secure, Transparent, and User-Centric DeFi-as-a-Service Solution.

Ben Sapper

FOUNDER & CEO, AMOTIUS

Effortless Platform Integration

Unify Your Key Systems with Ease

Users can effortlessly connect to diverse DeFi platforms, unlocking a plethora of decentralized financial services and opportunities.

Get answers

FAQ

We are here to provide you with the information and guidance you need to make the most of your experience with us.

DeFi is short for “decentralised finance,” an umbrella term for blockchain applications geared toward disrupting financial intermediaries.

DeFi draws inspiration from blockchain, the technology behind the digital currency Bitcoin, which allows several entities to hold a copy of a history of transactions, meaning it isn’t controlled by a single, central source. That’s important because centralized systems and human gatekeepers can limit the speed and sophistication of transactions while offering users less direct control over their money. DeFi is distinct because it expands the use of blockchain from simple value transfer to more complex financial use cases. Cutting out middlemen from all kinds of transactions is one of the primary advantages of DeFi.

Things are too complex for an everyday person. If the goal is mass user adoption where everyone is using DeFi, then there’s a need to simplify the entire user experience.

At a technological level, the tech is still too hard to navigate for the everyday user. There’s too much information, too many steps, too many different platforms, too many processes to follow to master this brilliant new technology. This needs to be streamlined in ways that support adoption and ease of use. With such a broad spectrum of users interested in DeFi, there are some huge gaps when it comes to the general understanding of financial products. Users might range from someone where it’s the very first wealth product they’ve used, to someone being an ex-Wall street financier. This creates a need for products that inherently educate the user whilst they use the product. This might be to support them in crypto/DeFi knowledge, or to share basic principles about wealth, risk and investing, so users are better equipped to make strategic wealth choices.

Without this education,DeFi experiences problems where users might be too adventurous or lack strategies around risk so they get hurt in the crypto space. At the other end of the spectrum, some are inactive, fearful or unwilling to play at all as they don’t have any comprehension of how to work with a mix of stable and volatile assets.

By staking the assets you own into DeFi protocols, you can earn profit commonly referred to in the space as “yield,” allowing you to grow your crypto stack without risking it through trading or other economic activities.

Volatile Assets

The crypto market is a relatively new market compared to other asset classes (E.G. – precious metals, stocks, bonds, real estate) it is therefore in its early stages of establishing itself. This naturally leads to significantly greater price fluctuations than with most traditional assets.

As the crypto market grows and further establishes itself, we are slowly seeing a reduction in the volatility, but this is something that is likely to be a significant factor for the foreseeable future. Even Stablecoins, in extreme circumstances, can be subject to price volatility.

Smart Contract Failure(Source:Binance Academy )

When you deposit funds into a liquidity pool, they are in the pool. So, while there are technically no middlemen holding your funds, the contract itself can be thought of as the custodian of those funds. If there is a bug or some kind of exploit, through a flash loan for example, your funds could be lost forever.

Platform Risk (Source: CoinDesk )

In order to achieve the highest possible returns for our customers, funds are held in smart contracts across several platforms. We at Amotius do everything in our power to ensure that we only interact with the safest and most established platforms, which are all subjected to various independent audits.

It is still important to note, that ultimately all platforms are subject to a certain degree of risk no matter the efforts we undertake to mitigate said risks.

For more detailed examples of some of these risks, you may refer to the following article.

https://www.coindesk.com/learn/2021/07/13/defi-lending-3-major-risks-to-know/